Economic Impact of COVID-19 Pandemic in India

Introduction

The COVID-19 pandemic, which began in early 2020, unleashed unprecedented challenges on global economies, with India experiencing one of its most severe economic disruptions since independence. As the world’s fifth-largest economy and home to over 1.3 billion people, India’s economic trajectory was dramatically altered by the pandemic, resulting in what many economists describe as the country’s fourth recession since independence and perhaps its most severe.

When India announced its first nationwide lockdown on March 24, 2020, few could have predicted the scale and duration of the economic impact that would follow. The Indian economy was expected to lose over ₹32,000 crore (equivalent to ₹380 billion or US$4.4 billion in 2023) every day during the first 21-days of complete lockdown. This dramatic halt to economic activity sent shockwaves through all sectors of the economy, from manufacturing and services to agriculture and retail.

“India’s fourth recession since independence, the first since liberalization and perhaps the worst to date, is here. State Bank of India research predicts a contraction of over 40% in the GDP in Q1 FY21.”— Economic Impact Assessment Report, 2020

This comprehensive analysis examines the multifaceted economic impact of the COVID-19 pandemic on India, tracing the initial shock, government responses, sectoral impacts, and the subsequent recovery path. Through detailed data analysis and visual representations, we aim to provide a holistic understanding of how COVID-19 reshaped India’s economic landscape and what lessons can be drawn for future crisis management and economic resilience.

Initial Economic Shock (2020)

The immediate impact of the pandemic and subsequent lockdowns was severe and far-reaching, affecting every aspect of the Indian economy. The abrupt halt to economic activities created a domino effect of disruptions across supply chains, employment, consumption patterns, and investment cycles.

The swift implementation of one of the world’s strictest lockdowns brought most economic activities to a standstill. While necessary from a public health perspective, this measure had immediate and severe economic consequences:

- Complete shutdown of non-essential businesses

- Massive reverse migration of urban workers to rural areas

- Disruption of supply chains both domestically and internationally

- Collapse in consumer demand across most sectors

- Severe liquidity challenges for businesses, especially MSMEs

The pandemic’s economic shock was unlike traditional economic downturns, as it affected both supply and demand simultaneously. Production facilities closed, workers couldn’t reach workplaces, supply chains were disrupted (affecting supply), while incomes fell and uncertainty rose (affecting demand).

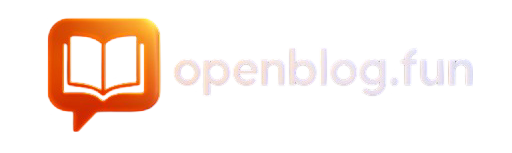

GDP Contraction and Financial Markets

The most stark indicator of COVID-19’s economic impact was India’s GDP contraction. From April to June 2020 (Q1 FY2020-21), India’s GDP dropped by a massive 24.4% – the worst quarterly performance since India began publishing quarterly GDP data in 1996.

According to the national income estimates, the economy contracted by a further 7.4% in the second quarter (July to September 2020). The recovery in the third and fourth quarters (October 2020 to March 2021) was still weak, with GDP rising only 0.5% and 1.6%, respectively. This resulted in an overall contraction of 7.3% for the entire 2020-21 financial year – India’s worst annual economic performance since independence.

| Quarter | GDP Growth Rate (%) | Key Factors |

|---|---|---|

| Q1 FY2020-21 (Apr-Jun 2020) | -24.4% | Nationwide lockdown, complete halt of non-essential activities |

| Q2 FY2020-21 (Jul-Sep 2020) | -7.4% | Partial reopening, supply chain disruptions |

| Q3 FY2020-21 (Oct-Dec 2020) | +0.5% | Festival season, gradual resumption of economic activities |

| Q4 FY2020-21 (Jan-Mar 2021) | +1.6% | Vaccine rollout, increased government spending |

| Overall FY2020-21 | -7.3% | Worst annual economic performance since independence |

Financial markets initially reacted with extreme volatility to the pandemic. The BSE Sensex and Nifty 50 indices experienced significant drops in March 2020, with circuit breakers being triggered multiple times. However, contrary to the real economy, the stock markets recovered relatively quickly, driven by liquidity injections by central banks globally and the shift of investments from other asset classes to equities.

Unemployment Crisis

The labor market faced unprecedented disruption during the pandemic. India’s unemployment rate, which stood at 6.7% on March 15, 2020, skyrocketed to 26% by April 19, 2020 – reflecting the immediate impact of the lockdown on jobs.

The unemployment crisis disproportionately affected certain segments of the workforce:

- Informal Workers: Approximately 40 crore (400 million) informal workers were at risk of falling deeper into poverty during the crisis. With no job security, social protection, or savings to fall back on, they were among the most vulnerable.

- Migrant Workers: The sudden lockdown triggered a massive reverse migration crisis, with millions of migrant workers attempting to return to their rural homes due to loss of urban livelihoods.

- Urban Employment: Urban areas, particularly in the service sectors like hospitality, retail, and transportation, witnessed higher job losses compared to rural areas.

- Youth Employment: Young workers and recent graduates faced particularly difficult job prospects, with many companies freezing hiring or conducting layoffs.

“Since the lockdown, approximately 40 crore (140 million) people lost their job and salaries were reduced for numerous people. The startup businesses suffered due to a huge fall in their funding.”— National Institute of Management & Technology, India

The unemployment crisis gradually abated as restrictions eased, but employment did not fully recover to pre-pandemic levels until late 2021, and the quality of employment (in terms of wages, benefits, and job security) remained compromised for many workers even after numerical recovery.

Sector-wise Impact Analysis

The pandemic affected different sectors of the Indian economy with varying intensity. While some sectors were devastated, others showed resilience or even growth during this challenging period.

Severely Impacted Sectors:

Aviation and Tourism

With travel restrictions and lockdowns, the aviation sector reported a change of -90.8% in corporate revenues from Q1 to Q2 2020. Tourism, which contributes approximately 9% to India’s GDP, virtually came to a standstill.

Hospitality and Entertainment

Hotels, restaurants, movie theaters, and other entertainment venues were forced to close for extended periods, resulting in massive revenue losses and widespread job cuts.

Retail (Non-essential)

Non-essential retail faced prolonged closures during lockdowns. Even after reopening, reduced foot traffic and consumer spending led to significant revenue declines.

Transportation

Public transportation, including railways and bus services, operated at significantly reduced capacity, while ride-sharing and taxi services saw dramatic declines in ridership.

Moderately Impacted Sectors:

Manufacturing

Factory closures, supply chain disruptions, and labor shortages severely impacted manufacturing initially, but the sector showed resilience with a growth of 9.8% in FY2021-22 as restrictions eased.

Construction

Construction activities were halted during lockdowns, but gradually rebounded as restrictions were lifted and government infrastructure projects resumed.

Real Estate

The real estate market faced significant challenges with project delays, reduced demand, and financing difficulties. However, residential real estate showed signs of recovery by late 2020.

Financial Services

Banks and financial institutions faced increased loan defaults and reduced new business, but government support and digital transformation helped mitigate some impacts.

Resilient or Growing Sectors:

Agriculture

The agricultural sector demonstrated remarkable resilience with a growth of 6.7% in FY2021-22, benefiting from good monsoons and relatively less disruption from lockdown measures.

Information Technology

The IT sector quickly adapted to remote work models and benefited from accelerated digital transformation across industries globally.

E-commerce

Online retail and delivery services experienced significant growth as consumers shifted to online shopping during lockdowns, accelerating e-commerce adoption by several years.

Pharmaceuticals and Healthcare

The pharmaceutical industry saw increased demand for medications and medical supplies, while healthcare services adapted to meet pandemic-related needs.

MSME Sector: The Hardest Hit

The Micro, Small, and Medium Enterprises (MSME) sector, which contributes nearly 30% to India’s GDP and employs over 110 million people, was particularly vulnerable to the pandemic’s economic shock. The sector’s structural characteristics – limited capital reserves, constrained access to formal credit, and high dependence on daily cash flows – made MSMEs especially susceptible to the prolonged disruptions.

Key challenges faced by the MSME sector included:

- Severe Liquidity Crunch: With business operations halted and cash flows disrupted, many MSMEs faced acute working capital shortages.

- Supply Chain Disruptions: Both domestic and international supply chains were severely affected, impacting MSMEs’ ability to procure raw materials and deliver finished goods.

- Labor Challenges: The exodus of migrant workers from urban centers left many MSMEs without their workforce when they were ready to resume operations.

- Reduced Demand: Consumer demand fell sharply due to income losses, uncertainty, and changed consumption patterns.

- Limited Digital Capabilities: Many MSMEs lacked the digital infrastructure to pivot to online operations or remote work arrangements.

The employment impact was particularly severe in the MSME sector. According to a comprehensive study, in MSMEs under examination, employment declined from 34,762 persons in 2019-20 to 26,154 persons in 2020-21—a reduction of approximately 25 percent due to the pandemic and lockdown measures. The impact was even more severe for informal workers within MSMEs, where employment decreased by 47.15 percent.

“The pandemic has raised an issue of survival for most of the micro, small, and medium enterprises (MSMEs) because of their vulnerability in terms of size.”— Journal of Small Business Strategy, April 2023

The recovery of the MSME sector has been uneven across different subsectors. Infrastructure-related businesses were among the fastest to recover, while consumer services MSMEs faced a more prolonged recovery period. Even by 2022, many MSMEs had not returned to their pre-pandemic operational levels, particularly those in urban service sectors.

Government Response and Recovery Measures

The Indian government responded to the economic crisis with a series of policy interventions and stimulus packages. The most significant was the “Atmanirbhar Bharat Abhiyan” (Self-Reliant India Movement) announced in May 2020, which included a comprehensive package worth ₹20 lakh crore (approximately $266 billion), equivalent to about 10% of India’s GDP.

Figure 6: COVID-19 Economic Response Flow Chart

- RBI reduced repo rate to 4%

- Liquidity measures

- Loan moratorium

- Atmanirbhar Bharat Abhiyan

- ₹20 lakh crore package

- Sector-specific measures

- Emergency Credit Line

- Subordinate debt

- Fund of Funds

Temporary setback to recovery

Key components of the government’s economic response included:

Monetary Policy Measures

- Reduction of repo rate to 4% (lowest ever)

- Liquidity injection of ₹3.74 lakh crore into the banking system

- Moratorium on loan repayments

- Special refinance facilities for NABARD, SIDBI, and NHB

MSME Support

- ₹3 lakh crore Emergency Credit Line Guarantee Scheme

- ₹20,000 crore subordinate debt for stressed MSMEs

- ₹50,000 crore equity infusion through MSME Fund of Funds

- Revised definition of MSMEs to include larger entities

Social Welfare Measures

- Direct benefit transfers under PM Garib Kalyan Yojana

- Free food grain distribution to 800 million people

- Enhanced MGNREGA allocation for rural employment

- Financial support for low-income women, senior citizens

Structural Reforms

- Agricultural marketing reforms

- Labor code consolidation

- Public sector enterprise policy

- Production-linked incentive schemes for manufacturing

Despite these extensive measures, their effectiveness varied significantly. The emergency credit schemes provided crucial liquidity support to businesses, but many small enterprises still faced challenges in accessing these benefits due to procedural complexities and pre-existing credit issues. Critics also noted that the actual fiscal impact of the package was considerably smaller than the announced figure, as it included previously budgeted expenditures and monetary measures by the RBI.

Recovery Trajectory (2021-2022)

India’s economic recovery from the COVID-19 shock has been gradual and uneven across sectors. After the severe contraction in FY2020-21, the economy rebounded with an estimated growth of 8.7% in FY2021-22, though this high growth rate partly reflects the statistical base effect of the previous year’s contraction.

The recovery trajectory has been characterized by several key features:

K-Shaped Recovery

India’s economic recovery has been distinctly K-shaped, with large corporations and formal sector employees recovering faster than small businesses and informal workers. This has exacerbated pre-existing economic inequalities.

Second Wave Disruption

The devastating second wave of COVID-19 in April-May 2021 temporarily halted the recovery momentum. However, the economic impact was less severe than during the first wave, as lockdowns were more localized and businesses had adapted to pandemic conditions.

Sectoral Divergence

The recovery has been asynchronous across sectors. Manufacturing and agriculture rebounded relatively quickly, while contact-intensive services like hospitality and entertainment faced a more prolonged recovery period.

Digital Acceleration

The pandemic accelerated digital adoption across businesses and consumers. E-commerce, digital payments, and remote work technologies saw significant growth, helping certain segments of the economy recover faster.

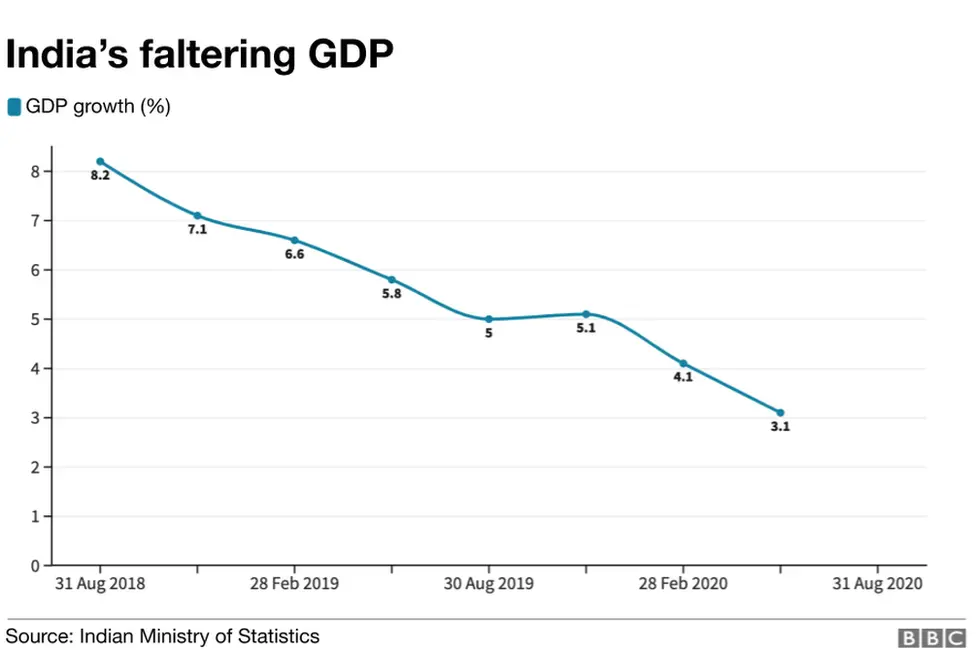

By the end of 2022, several economic indicators had returned to or exceeded pre-pandemic levels:

- GST collections consistently exceeded ₹1.4 lakh crore from April 2022 onwards

- Manufacturing PMI remained in expansion territory

- Export growth showed strong momentum despite global headwinds

- Unemployment rates approached pre-pandemic levels, though underemployment remained an issue

However, complete economic normalization faced challenges from global factors including supply chain disruptions, commodity price inflation, and geopolitical tensions following Russia’s invasion of Ukraine in early 2022. Domestically, private consumption—particularly in lower-income segments—remained subdued compared to pre-pandemic levels, indicating ongoing strain in household finances.

Lessons Learned and Future Outlook

The COVID-19 pandemic exposed both vulnerabilities and resilience in India’s economic structure. Several important lessons have emerged from this crisis that can inform future economic policy and business strategies:

Social Safety Nets

The crisis highlighted the critical need for comprehensive social safety nets to protect vulnerable populations during economic shocks. The absence of universal social security left millions of informal workers exposed to severe hardship.

Digital Infrastructure

Businesses and governments with robust digital capabilities proved more resilient. Accelerating digital infrastructure development and digital skills training is essential for future economic resilience.

Supply Chain Resilience

The disruption of global supply chains underscored the importance of building more resilient and diversified supply networks, potentially with greater localization of critical components.

Looking ahead, India’s economic outlook remains cautiously optimistic, with several structural shifts likely to shape the post-pandemic economic landscape:

Opportunities

- Manufacturing Potential: Global supply chain reorganization presents opportunities for India to emerge as an alternative manufacturing hub.

- Digital Economy Growth: Accelerated digital adoption opens new avenues for innovation, entrepreneurship, and job creation in technology-enabled sectors.

- Economic Reforms: The crisis has catalyzed structural reforms in areas like agriculture, labor, and privatization that could enhance long-term economic efficiency.

- Green Recovery: Integrating sustainability into recovery plans can drive investments in renewable energy and green infrastructure.

Challenges

- Fiscal Constraints: The elevated public debt levels resulting from pandemic spending limit fiscal space for future development investments.

- Banking Sector Stress: Potential rise in non-performing assets as pandemic-related regulatory forbearance is withdrawn.

- Inequality: Addressing the widened economic disparities between different segments of the population and between urban and rural areas.

- Global Uncertainties: Ongoing geopolitical tensions, inflation concerns, and potential global economic slowdown could impact India’s export-led growth prospects.

Policy priorities for sustaining and broadening the economic recovery include:

- Continued focus on infrastructure development to create jobs and enhance economic efficiency

- Support for MSME recovery through simplified compliance, better credit access, and technology adoption assistance

- Investment in health and education systems to build human capital and enhance pandemic preparedness

- Gradual fiscal consolidation while protecting critical social and infrastructure spending

- Targeted skilling and reskilling programs to address pandemic-induced labor market disruptions

Conclusion

The COVID-19 pandemic delivered an unprecedented shock to India’s economy, triggering its deepest recession since independence. The immediate impact was severe across all dimensions – output contracted sharply, millions lost jobs, businesses struggled to survive, and fiscal balances deteriorated. The most vulnerable sections of society – informal workers, daily wage earners, and small businesses – bore a disproportionate share of the economic hardship.

However, the crisis also demonstrated remarkable resilience in certain sectors of the economy and accelerated important transitions, particularly in digital adoption. The government’s policy response, while not without limitations, helped prevent an even deeper economic collapse and laid the groundwork for recovery.

As India emerges from the pandemic’s shadow, the recovery remains uneven across sectors and population segments. The K-shaped recovery trajectory highlights the need for more inclusive growth policies that ensure economic gains are broadly shared. The experience has underscored structural vulnerabilities in the economy – from inadequate social safety nets to over-reliance on certain global supply chains – that require sustained attention.

Looking ahead, India has an opportunity to rebuild its economy on stronger, more resilient, and more sustainable foundations. By addressing the lessons from this crisis – strengthening health systems, expanding social protection, fostering digital capabilities, and enhancing economic resilience – India can not only recover from the pandemic’s impact but potentially emerge with a more dynamic and inclusive economy for the future.

The COVID-19 pandemic’s economic impact will leave a lasting imprint on India’s development trajectory, but with appropriate policy choices and private sector adaptation, the recovery can become a springboard for more robust and equitable growth in the coming decades.